Netback

GFC FEES AND NETBACK PERFORMANCE

GFC’s culture for 40 years has been predicated on winning liquidity battles in a customer service and compliance minded fashion. GFC places a strong emphasis on investing in superior staff, advanced technology, robust compliance training and monitoring, and comprehensive employee retention programs. These services have demonstrated over our 40-year history a higher netback rate of return to the client.

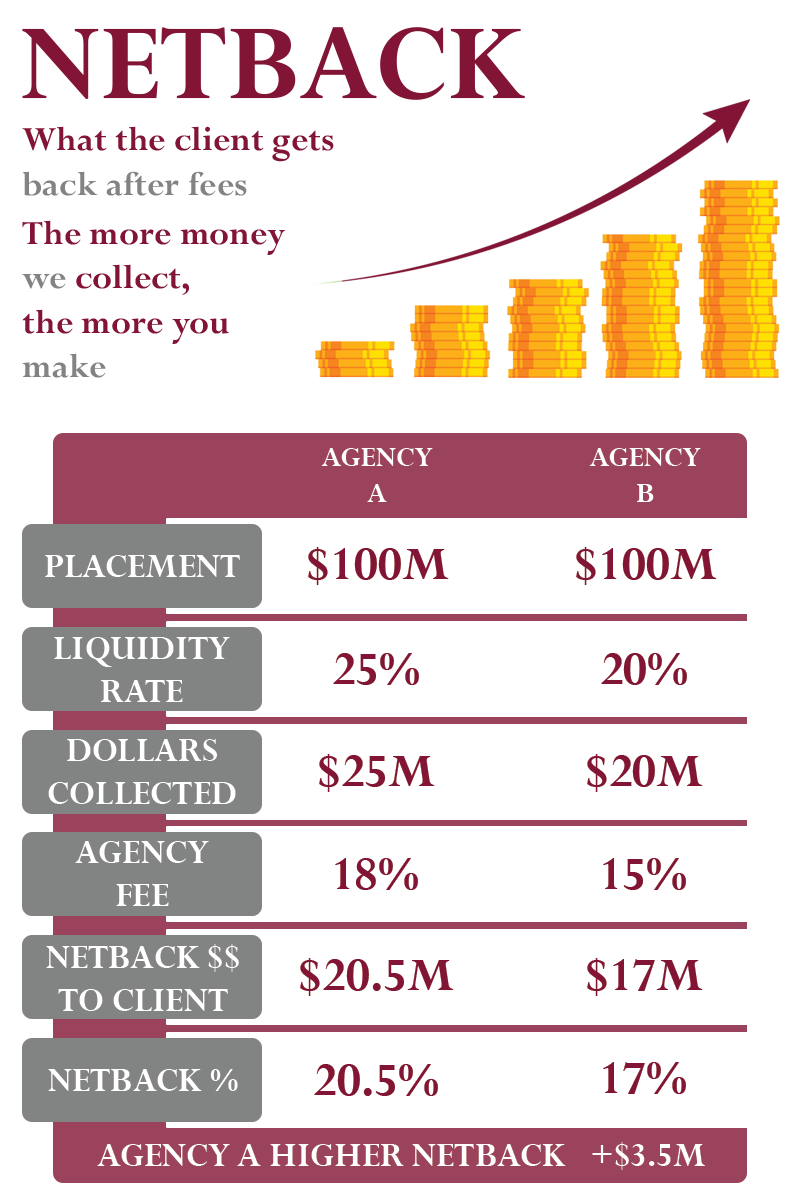

In evaluating the performance of agencies like GFC, the most effective and trusted tool is the "Netback Method". The Netback method truly demonstrates which agency is returning more cash to the client. The following table is a comparison of the performance of two agencies:

The table shows that Agency A charges an 18% fee and has a liquidity rate of 25%, while Agency B charges a 15% fee and has a lower liquidity rate of 20%, which results in a netback of $3,500,000 more from Agency A to the client. In the netback analysis, Agency A clearly outperforms Agency B.